The current financial system is broken – fees, charges, lack of control, and the middleman always takes a cut. It’s about to change with the emergence of Finance 3.0 and DeFi! It’s hard to believe that just a few decades ago, the world of finance was still in its infancy. Centralized institutions like banks and governments dominated finance. Transactions were slow and expensive, and the average person had little control over their finances.

Thankfully, we’ve come a long way since then, and a new Finance era is here – Finance 3.0. It’s bringing a whole new level of convenience and efficiency. Finance 3.0 is the future’s open financial system, which gives users more control and reduces or eliminates the middleman, fees, charges, penalties, etc. In other words – it’s the time for cryptocurrencies and decentralized finance (also known as DeFi) to allow us to bypass intermediaries and fees, giving us more control over our money.

Despite the challenges, decentralized finance is here to stay. With its potential for increasing transparency and efficiency, DeFi has the power to transform the world of finance for the better. However, we didn’t get here overnight, and to understand better the differences, let’s go through the finance development stages from 1.0 to 3.0 and how to invest in the future.

Finance 1.0 – Emergence of Banks

We can describe finance 1.0 as the conventional financial system, which began with the creation of banks and fiat money. One of the main reasons for the rise of fiat currencies was that people started to hold their money in banks for safety and better investment returns. In addition, fiat currencies are not backed by any physical commodity, like gold or silver. Fiat currencies are fully controlled by governments and can cause chaos in the financial system if managed poorly. I.e. Hyperinflation in Zimbabwe is a great example of poorly managed fiat currency by the government.

Common Finance 1.0 issues

- Long queues and slow operations.

- Possible errors (Because humans record financial transactions manually).

- Various scams and no technology for scaling.

- Issues with international payments.

- Potential damage or loss risks.

- High transaction fees.

- Robberies.

- Etc.

Finance 2.0 – Emergence of Technology

The evolution of new technologies and the Internet has allowed the Finance sector to advance to the next level – Finance 2.0. The current financial system, in which consumers have little control but faster transactions, quick account openings and centralised solutions overseen by financial institutions and governments, is known as Finance 2.0. It was when payment gateways and networks began to emerge. PayPal, Revolut, N26, VISA, and MasterCard are examples of such financial institutions.

Common Finance 2.0 issues

- A closed financial system where banks and governments are still in control (Centralised solutions).

- Users have no or little control over their money.

- Banks or payment companies take a cut.

- Issues with frozen and blocked accounts.

- Banks generate profit from users’ money.

- Etc.

Finance 2.0 is outdated and doesn’t work for the modern world anymore. Fees, charges, middlemen, etc., are all too common, and people are looking for a better solution.

Finance 3.0 – Open finance and DeFi

And here we are today – slowly transitioning from Finance 2.0 to Finance 3.0. One of the most important aspects of Finance 3.0 is the rise of decentralized finance, or DeFi for short. DeFi offers several benefits over traditional finance, including lower fees, reduced risk, and increased transparency. While there are some risks associated with DeFi and many challenges ahead, the potential rewards make it a viable option for many people and businesses. Let’s take a closer look at DeFi and what it brings to the table.

What is Decentralised Finance (DeFi)?

Decentralised Finance (DeFi) is a term for financial applications that run on a blockchain or decentralized network. DeFi is growing in popularity, with more than $150 billion worth of assets now being managed in DeFi products. DeFi applications are typically open-source, scalable, and transparent. This makes them ideal for use in financial transactions that require security and accountability.

Downsides of DeFi

DeFi is still in its early stages and many projects have not been fully developed. DeFi is also based on blockchain technology, so it’s subject to the same volatile market conditions as other cryptocurrencies.

So far, DeFi has been largely unregulated, which has led to some scams and hacks. Additionally, DeFi is still in its early stages, which means that there are bound to be some bumps in the road. Currently, the cryptocurrency market is heavily unstable, and there is a massive lobby against DeFi from the traditional banking sector.

How is DeFi used?

Today, DeFi is used in several ways. One popular use case is the creation of decentralized exchanges. Decentralized exchanges are exchange platforms that do not require using a third party to facilitate transactions. This allows for increased security and transparency, as well as reduced fees. Additionally, DeFi is used to create decentralized lending platforms. These platforms allow users to borrow and lend cryptocurrencies without needing a third party. In short – higher returns to lenders.

How to invest in DeFi?

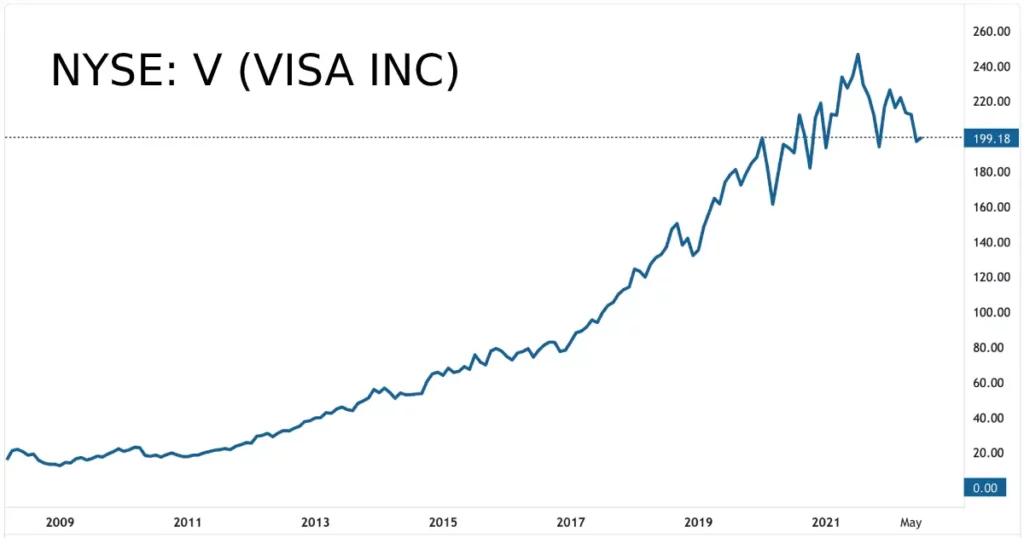

Finance 2.0 has taught people that investing in financial technology can bring great returns. I.e. VISA Inc’s stock price grew by 1,180% since its IPO in 2008. That’s around +84% per year!

Past investor success stories and a fear of missing out – drive many investors to the cryptocurrency market. Cryptocurrency investments come with increased risk because of the volatile nature of the asset. However, it doesn’t stop many investors from investing in this asset class.

Time needed: 10 minutes

If you want to trade cryptocurrencies and understand the risks involved, here are the steps to invest in DeFi cryptocurrencies.

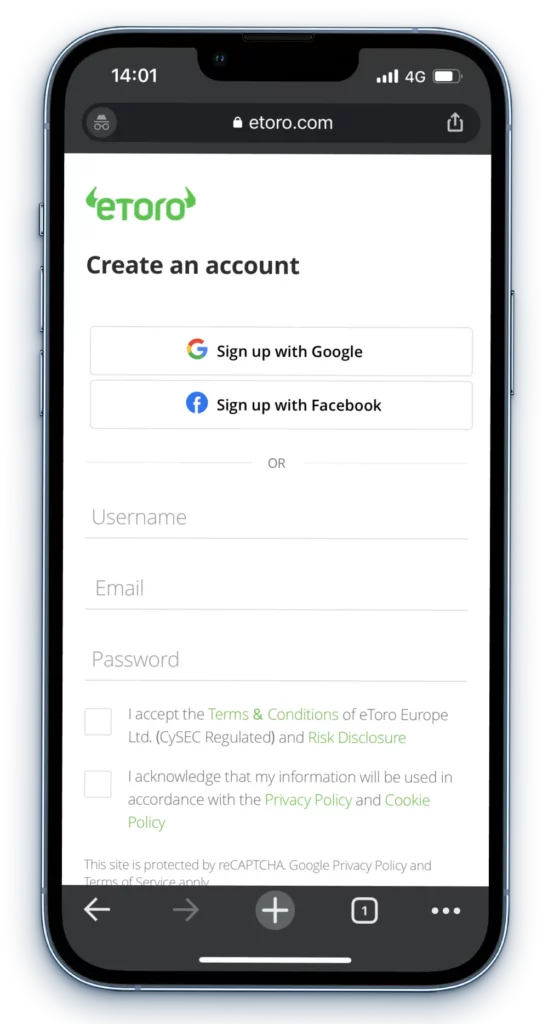

- Open an account with a broker

Open an account with a broker where you can buy or trade cryptocurrencies. I.e. eToro.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong. Take 2 minutes to learn more.

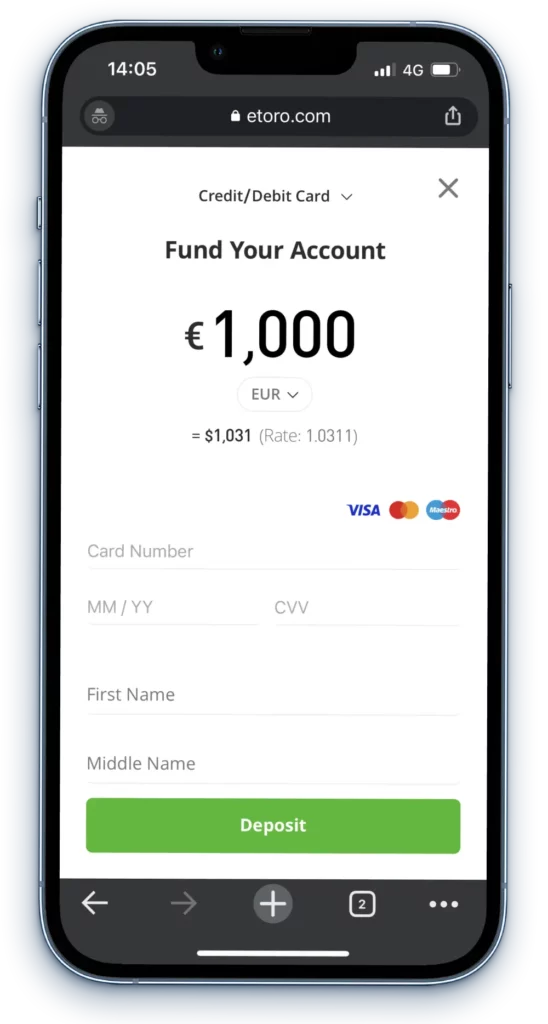

- Deposit at least the minimum amount

You must deposit at least the minimum amount to buy or trade cryptocurrencies. With eToro, it varies from 50 USD to 1,000 USD (Depending on your residency). Also, if you want to test the platform, you can simulate cryptocurrency trading in the free eToro free demo account.

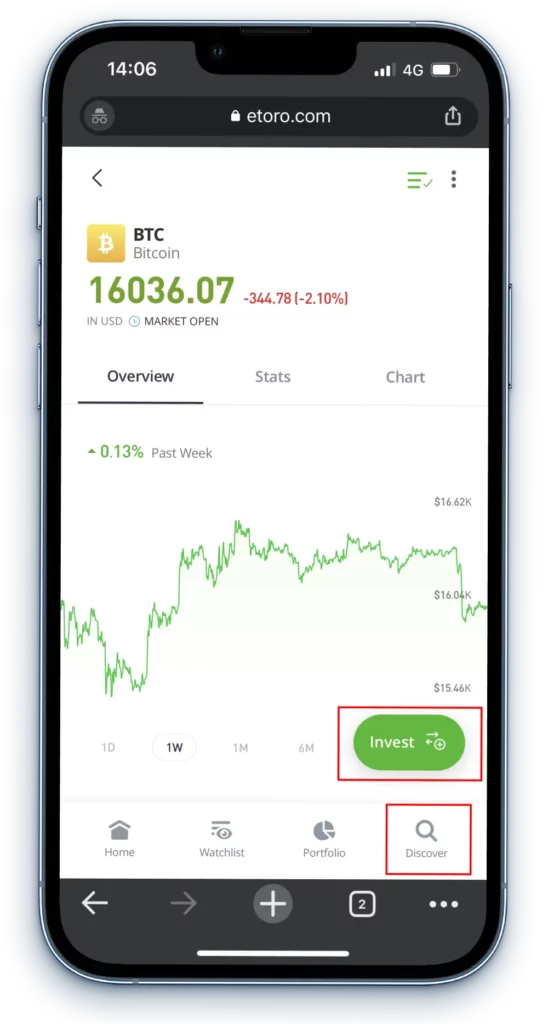

- Pick a cryptocurrency you want to trade

If you want to invest in DeFi cryptocurrencies, then on the eToro platform, you can trade the following DeFi cryptocurrencies: Bitcoin, Avalanche, Chainlink, Uniswap, Maker, Aave, The Graph and others.

- That’s it!

Once you’ve chosen the cryptocurrency to invest in, open trade.

Remember, investing in cryptocurrencies is risky, and you should always consult a professional if you don’t understand what you’re doing.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong. Take 2 minutes to learn more.

If you’d like to understand more about the fees involved and the process of investing in cryptocurrencies on eToro, you can read more in the eToro crypto review. However, eToro is not the only place to buy DeFi cryptocurrencies. You can also check the available cryptocurrencies on Revolut.

Conclusion

Despite these challenges, I believe that decentralized finance is here to stay. With its potential for increasing transparency and efficiency, DeFi has the power to transform the world of finance for the better.

What do you think? Is DeFi something you’re interested in exploring further? Let me know in the comments!